Cybersecurity and PayID: Addressing Concerns and Ensuring Safe Transactions

Innovative payment systems, such as PayID, have revolutionized the way we transfer money and conduct transactions online. However, with convenience comes the inherent risk of cybersecurity threats. As they say, no digital payment solution can guarantee 100% security.

This article highlights the implications of cybersecurity in the context of PayID, including the concerns and measures to ensure safe transactions in this evolving digital landscape.

Understanding PayID

Before we address the burning question of safety, let’s take a closer look at what PayID actually is. It is a form of electronic payment introduced in Australia in 2018 to overcome incorrect payments as well as reduce fraud. This was achieved by showing the recipient’s name to the person making the transaction. The same effect had the reduction of the need to remember bank accounts and BSB numbers.

You can use PayID to shop online, send money, or receive payments. Even gamers can use it to make deposits and withdrawals in online casinos. Actually, there are hundreds of casinos in Australia that accept this method. A good number of them offer no-deposit bonuses.

This type of bonus allows players to explore casino offerings and win real money without the need for an initial financial commitment. You can explore any PayID pokies no deposit bonus available in Australia by visiting your favorite gambling sites.

Setting up a PayID for Transactions

To set up a PayID, Aussies can use their email address, ABN, or phone number as a means of identification. The bank will authenticate the ownership of the provided information and then associate the person’s bank account with this unique identifier. To transfer money, follow these steps:

- Enter the recipient’s PayID when prompted by your online banking system to initiate a money transfer.

- Type in the recipient’s email address, ABN, or phone number to reveal their name on the system.

- Verify the accuracy of the displayed name. If correct, proceed to authorize the payment.

- If the displayed name is incorrect, cancel the transaction to prevent any errors.

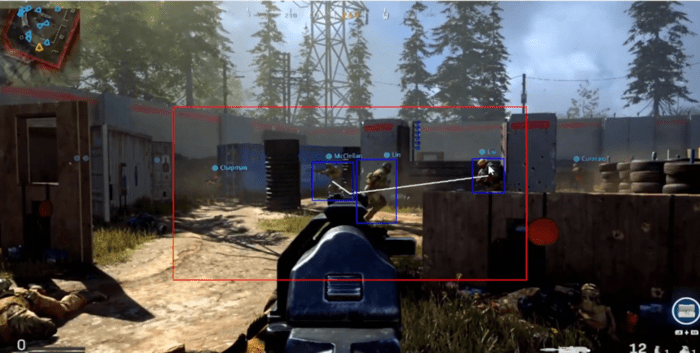

Cybersecurity Concerns in PayID

Being a relatively new player in the digital payment landscape, PayID has drawn the attention of cybercriminals seeking vulnerabilities to exploit. Below are some possible scenarios to consider:

| Security Concerns | Description |

| Impersonation and identity theft | Concerns about potential impersonation and identity theft. Cybercriminals may compromise user identities. |

| Phishing | PayID is susceptible to phishing scams where hackers trick users into revealing their identifiers through fraudulent emails. |

| Account takeovers | Compromised PayID-linked account details can lead to unauthorised access and transactions by fraudsters. |

An Example of PayID Scam Targeting Online Marketplaces

Instances of PayID scams have been reported, particularly targeting individuals engaged in online sales through platforms like Gumtree and Facebook Marketplace. In these scenarios, scammers often approach sellers, expressing interest in making a purchase. A common tactic involves the scammer asserting that a friend or family member will collect the item on their behalf. To facilitate the transaction, the seller is encouraged to accept payment through PayID. Once the information is shared, the scam escalates.

Subsequently, the scammer may claim to have made a payment but assert that it cannot be processed due to an alleged issue with the account. They then press the seller to make additional payments or upgrade the account to release the funds. Another tactic involves the scammer asserting an overpayment and requesting reimbursement of the excess funds. If the seller transfers money in response, it directly goes to the fraudster, resulting in financial loss.

How to Protect Yourself from PayID Scams

The best way to shield yourself against these scams is to know about the tricks fraudsters use. Below are some of them:

- Be cautious of buyers proposing to use PayID but claim to have issues with the transaction. Never initiate a payment before receiving funds.

- Your bank manages PayID. Disregard communications claiming to be directly via text, calls, or emails.

- PayID upgrades to business or premium accounts are free. Avoid paying for any alleged upgrade.

- Refrain from relying on confirmation emails showing an overpayment from a buyer. Such emails are fraudulent, and no actual funds will be deposited into your account.

How PayID and Banks Are Addressing Cyber Security Concerns

PayID, prioritizing robust security, incorporates encryption as a fundamental measure, ensuring the protection of transmitted data from unauthorized access. Complementing this, advanced fraud detection systems scrutinize transactions for irregularities, swiftly identifying potential fraud like large or unusual transfers. Multi-factor authentication (MFA) adds an extra layer of security, with many institutions mandating users to enable it for identity verification through various means.

To mitigate risks further, PayID implements transaction limits, a common practice across payment platforms and banks, reducing potential losses in the event of a security breach. User education is emphasized, with institutions regularly imparting best practices such as creating strong passwords, avoiding public Wi-Fi for transactions, and recognizing phishing attempts. Collaboration with cybersecurity experts ensures PayID service providers stay informed about evolving threats, maintaining the system’s resilience against contemporary cybersecurity challenges.

What to Do if You Have Been Scammed

If you fall victim to the PayID scam, contact your bank right away. Swift action is crucial. Take time to report any financial losses and misfortunes to ReportCyber. This is a digital police reporting portal for forwarding cyber incidents.

Alternatively, you can report the incident to Scamwatch, a program that offers to small businesses and consumers about how to identify and avoid scams. If your personal information has been compromised, seek help from IDCARE.

As of December 2023, Australians have reported over $32 million in losses from various scams, including scams. Exercise caution when buying or selling online, and refer to the Scamwatch website for information on different types of scams.

Final Thoughts

Securing PayID transactions requires a proactive cybersecurity strategy. Robust measures, including encryption, continuous monitoring, and user authentication, are essential to thwart unauthorized access and safeguard sensitive data. Collaboration among stakeholders and adherence to industry-wide standards will fortify this ecosystem against evolving threats. Ongoing user education and prompt responses to emerging risks are crucial for maintaining a resilient framework.

By prioritizing cybersecurity, the financial industry can build trust, ensure secure transactions, and fully unleash the potential of PayID in our increasingly digitized financial landscape. It is through this concerted effort that we can establish a foundation for widespread adoption, fostering confidence among users and stakeholders alike in the seamless and secure future of digital payments.